Smarter factories: How 5G can jump-start Industry 4.0

Theme Spotlight Sponsor Blog

Post date

February 8, 2021

Even as manufacturing has made technological strides, communications limitations have proven to be an obstacle to more dramatic, valuable change. Advanced connectivity could be the missing ingredient.

By: Ondrej Burkacky, Zina Kolesova and Stephanie Lingemann

In recent decades, a wide range of technological advances, in such areas as data collection, analytics, machine learning, and augmented reality, has fueled the rise of smart, automated factories. Yet connectivity has remained a critical barrier to realizing the full potential of what is collectively known as Industry 4.0. Even the most advanced factories of today still largely depend on inexpensive Wi-Fi networks that have several drawbacks, such as interference in dense settings and complex fixed connections that are difficult to manage in large industrial settings.

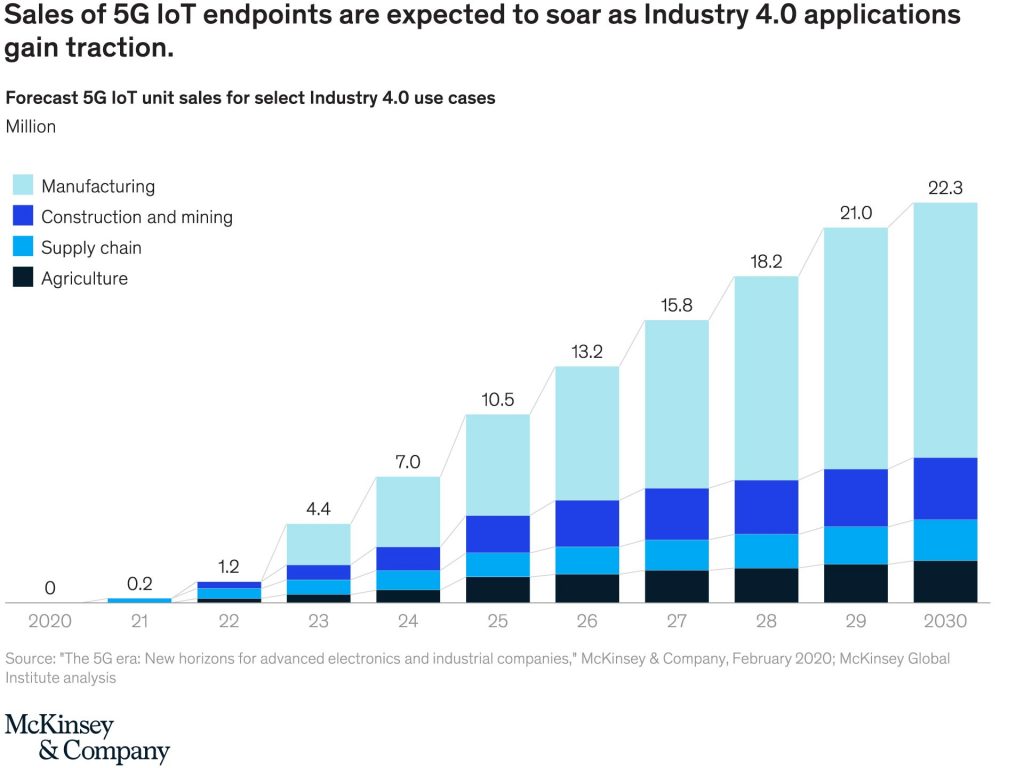

Now the emergence of advanced connectivity technologies such as high-band 5G can provide manufacturers a reliable alternative. This will enable critical communications, such as the wireless control of machines and manufacturing robots, that will unlock the full potential of Industry 4.0, including the mass proliferation of 5G-specific IoT devices (exhibit). By 2030, as a result, the manufacturing sector could generate an additional $400 billion to $650 billion of global GDP impact, according to research by the McKinsey Global Institute (MGI) and the McKinsey Center for Advanced Connectivity. Much of this value would be realized through five of the most promising use cases for public or private high-band 5G networks.

Exhibit

Vision quality checks

Quality control can greatly improve with connectivity-enhanced visual inspections that rely on real-time analytics to spot deviations quickly and early. Traditional machine vision models require about eight months to develop, whereas AI algorithms can be trained for use within weeks. Potential value: $50 billion to $100 billion.

Augmented reality (AR)

AR glasses can help to display instructions in workers’ visual fields, but such tools must process data in real time to be effective in production, logistics, and R&D. High-band 5G offers the low-latency and high-speed communication needed for data processing to occur on the edge, reducing costs and increasing energy efficiency. Potential value: $45 billion to $75 billion.

System-wide real-time processing control

Advanced analytics that optimize and adjust processes on assembly lines and across multiple plants, often with the help of sensor-driven analyses, can capture value for manufacturing companies. Frontier connectivity enables reliable, wireless, and low-latency communication that can help significantly reduce defects, rework, and breakdowns. Potential value: $130 billion to $200 billion.

Automated guided vehicles (AGVs)

Transport vehicles used in factory logistics today primarily operate on fixed paths or have limited capabilities for optimizing routes. The low latency of frontier connectivity will enable large fleets of next-generation AGVs that can make sophisticated, analytics-driven navigation and coordination decisions in the real-time context of other connected machinery. Potential value: $130 billion to $200 billion.

3-D bin picking

With the help of advanced and frontier connectivity, robots equipped with sophisticated vision systems will be able to find parts anywhere on site, rather than just in fixed, known locations, as most of today’s factory machines are only capable of doing. Since enhanced connectivity enables data analysis in the cloud or on the edge, such robots will require minimal internal processing power. Potential value: $30 billion to $50 billion.

As great as the connected manufacturing opportunity could be, it will be equally complex, and industrial companies will need to have a clear strategy to begin to seize it. Most importantly, manufacturers and other advanced industrial companies will need to work with partners and suppliers outside their traditional ecosystem. Advanced warehouse management using AGVs, for instance, will require collaboration with technology providers, infrastructure providers, and equipment and vehicle manufacturers.

This may not be an easy shift for manufacturers. They tend to have large asset bases that are challenging and costly to upgrade, and a top-down organizational culture that may be slow to embrace such a radical, new business case. But there are many potential partners that should make the prospect less daunting.

Technology providers can help manufacturers decide upon a “just right” solution that delivers the best return on investment. Industrial automation players will have their own critical role, and they will be highly motivated to have their new offerings reviewed by early adopters. Since data security and network reliability will be essential, large manufacturers (or any with deep enough pockets) will likely opt for private 5G networks, which will require close coordination with telecom operators and network specialists. Daimler, for example, has partnered with Telefónica and Ericsson to develop a private 5G network for automobile production, while Audi has teamed up with Ericsson to implement 5G technology more broadly in the Audi Production Lab. Likewise, application and solution providers can contribute to the implementation of actual Industrial 4.0 features. Volkswagen has joined with AWS to build an industrial cloud for IoT devices.

Many manufacturers may still prefer to take a more tentative, wait-and-see approach at the outset. But the costs of inaction on advanced connectivity could well turn out to be high—so much so that those that wait too long to start laying the foundation for Industry 4.0 may soon find that even today’s more high-tech factories are no longer built on solid ground.

This post, part of an ongoing series, was adapted from a recent McKinsey report, The 5G era: New horizons for advanced-electronics and industrial companies, and the MGI/MCAC discussion paper, Connected world: An evolution in connectivity beyond the 5G revolution.