High-band economics: Can mmWave spectrum make 5G networks more cost effective?

Blog

Post date

January 21, 2021

With 5G rollouts and adoption progressing quickly, and with the mmWave ecosystem showing signs of readiness, the main question that the mobile industry faces today is whether and where mmWave solutions can be cost effective.

In this blog, GSMA’s Head of Greater China, Sihan Chen, investigates recent research from GSMA Intelligence about how mmWave spectrum can lead to targeted and cost-effective 5G deployment. The study looked at dense urban areas in Greater China and Europe in the period between now and 2025. It aimed to provide insight into whether common 5G use cases could be more cost effectively supported with, or without, the use of mmWave spectrum.

GSMA Intelligence developed a model that considered key supply and demand factors:

- the spread and density of users in an area

- the share of users that are actively downloading data using 5G networks at the same time

- the inter-site distance required between cells.

2020 will always be remembered as the year when a new virus rapidly spread across the world, causing a global pandemic. In telecoms, some of us will also remember it as the year that saw 5G being commercially launched in most major markets worldwide: by the end of 2020, 140 operators in nearly 60 markets had already launched 5G services.

The roll-out of 5G networks is going hand in hand with the opportunity to rethink mobile networks more generally. This includes some relatively new initiatives like open networks, network virtualisation or cloud edge. In time, all these solutions will play a critical role in mobile networks. Other innovative solutions, like the use of millimetre (mmWave) spectrum, have been touted for much longer but we are now seeing them come to the fore.

mmWave spectrum: clear signs of 5G market readiness

For many years we have heard about how mmWave spectrum could be put to use by mobile operators, but it is only relatively recently that we have seen clear signs of market readiness. How far and deep mobile operators will go in developing new network models, including mmWave, will largely shape the range and quality of services that the mobile industry can offer in the near future. Critically, network model choices will also play a big role in determining the deployment costs of 5G networks.

5G deployment costs are precisely the focus of a recent GSMA Intelligence study where we evaluate the cost effectiveness of deploying mmWave 5G solutions in six different scenarios, including dense urban areas, Fixed Wireless Access (FWA) and indoor deployments, in the period to 2025. The goal of the study was relatively straightforward; provide insight into whether common 5G use cases could be more cost effectively supported with, or without, using mmWave spectrum. The backdrop to the research was a set of well-known mmWave deployment realities (good and bad).

mmWave: a complex story

It is often argued that there are significant technical challenges for the use of mmWave in mobile networks: mmWave signals travel relatively short distances compared to lower frequency bands, can be susceptible to attenuation from trees and other obstacles, and have difficulties in penetrating concrete building walls (often necessary to reach indoors). Others argue (also rightly), that mmWave radio-equipment infrastructure is today more expensive relative to existing low-band and mid-band solutions. However, mmWave attenuation plays directly into operator strategies around network densification, and the cost gap between Sub 6 GHz and mmWave solutions decreased in 2020. Costs will continue to fall in 2021 and beyond. Rapid growth in 5G mobile data traffic also plays to the strengths of mmWave bands: mmWave can accommodate more capacity and bandwidth than any other band. In other words, from a technical perspective, the mmWave story is a complex one.

At the same time, mmWave spectrum is now becoming more widely available, with countries such as the US, Italy, Finland, Japan and South Korea having already released mmWave spectrum for 5G. Another sign of market readiness is a sufficiently wide choice of consumer devices and equipment. Consumer devices in particular have recently seen remarkable growth, with the launch in late 2020 of the new mmWave-capable iPhone 12 series giving a boost to wider adoption of the technology. While only a few handsets and FWA (Fixed Wireless Access) CPEs (Consumer Premise Equipment) were available just over a year ago (2019), consumers can expect more than 100 mmWave 5G handsets and more than 50 FWA CPEs to be available in 2021.

When and where will mmWave solutions be cost effective?

In our recent study, we developed a very granular cost model that considers the main factors driving 5G networks capex and opex. To cite a few of these factors, the model considers key supply and demand levers such as the spread and density of users in an area, the share of users that are actively downloading data using 5G networks at the same, the spectral efficiency of the network, or the inter-site distance required between cells. Such detailed cost modelling provides some unique insights:

- The study looked at dense urban areas in Greater China and Europe in the period between now and 2025. We find that a mixed 3.5 GHz and mmWave network can be cost effective when compared to a 3.5 GHz-only network. The results are particularly sensitive to the intensity of traffic demand and operator market share in a given area, and to the amount of spectrum assigned per operator on each band.

- We also considered FWA deployments in urban China, suburban Europe, and a representative rural town in the U.S. Again, we find that 5G FWA networks using mmWave spectrum can be a cost-effective strategy where 5G FWA is able to capture a good percentage of the residential broadband market demand.

- Finally, we considered an indoor office scenario. When a significant share of data traffic from devices needs to be supported by indoor 5G services, a mixed 3.5 GHz and mmWave public network deployment in a large office space with limited outdoor coverage could generate cost savings of up to 54%.

Whether deploying mmWave in 5G networks is a cost-effective strategy for an individual operator in 2021, in 2024, or later will depend on each mobile operator’s circumstances in different areas, including data traffic, operator market shares and/or spectrum portfolios. Yet, independent of the particular modeling results for each scenario, the emerging conclusion is that the high throughput capabilities of mmWave can lead to some targeted and cost-effective mmWave 5G deployments in the period between now and 2025.

Use case: dense urban area in Greater China

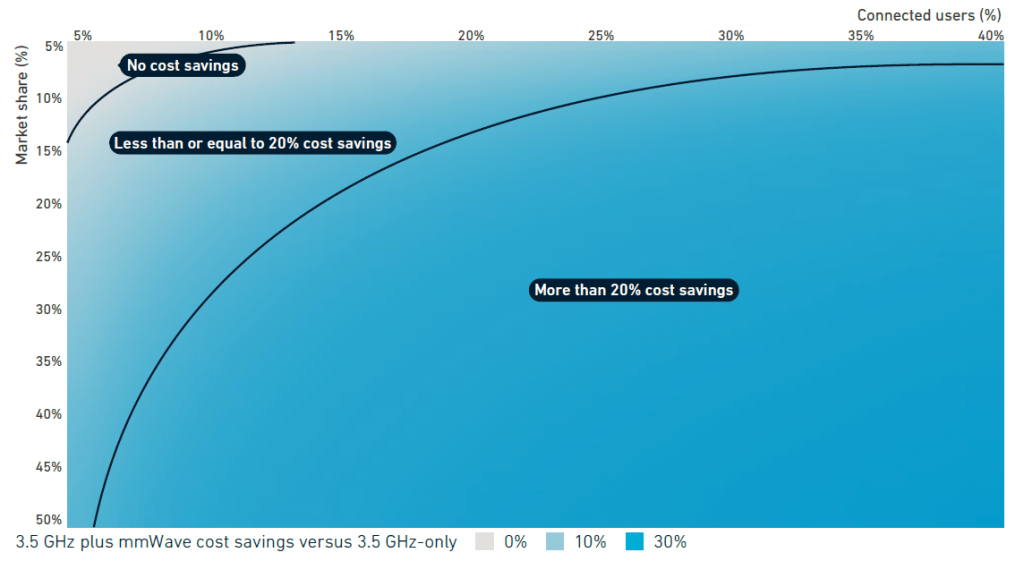

The chart below illustrates this point. Taking for example the case of a dense urban area in Greater China, when an operator has a limited market share and faces little traffic demand, the use of mmWave spectrum alongside 3.5 GHz spectrum would deliver no cost savings. However, large cost savings (of around 30%) would be achieved when the operator has a more significant market share in the local area and the percentage of connected 5G users at peak demand is higher.

Cost savings in the dense urban scenario in China – at least 100 Mbps download speeds

Of course, this is all more than just an academic exercise. The analysis has therefore clear implications for all actors in the mobile ecosystem:

- Operators that underestimate the role of mmWave in the short term run the risk of finding themselves at a disadvantage to competitors when offering 5G services.

- Governments looking to capitalize on 5G as a catalyst of economic growth need to make clear plans for the assignment of mmWave bands to mobile services.

- For vendors, it is clear that as mmWave 5G solutions achieve more scale, a wider choice of consumer devices and equipment will help further reduce deployment costs, increase the choice of affordable devices available and facilitate greater adoption.

“The economics of mmWave 5G, an assessment of total cost of ownership in the period to 2025” from GSMA Intelligence is available to download. Executive summary available here.